INCOME PRODUCING ASSET CLASS

Earn High Rentals Through Corporate Lets

Through a combination of short term lets to corporate and private tenants, investors can potentially achieve higher returns.

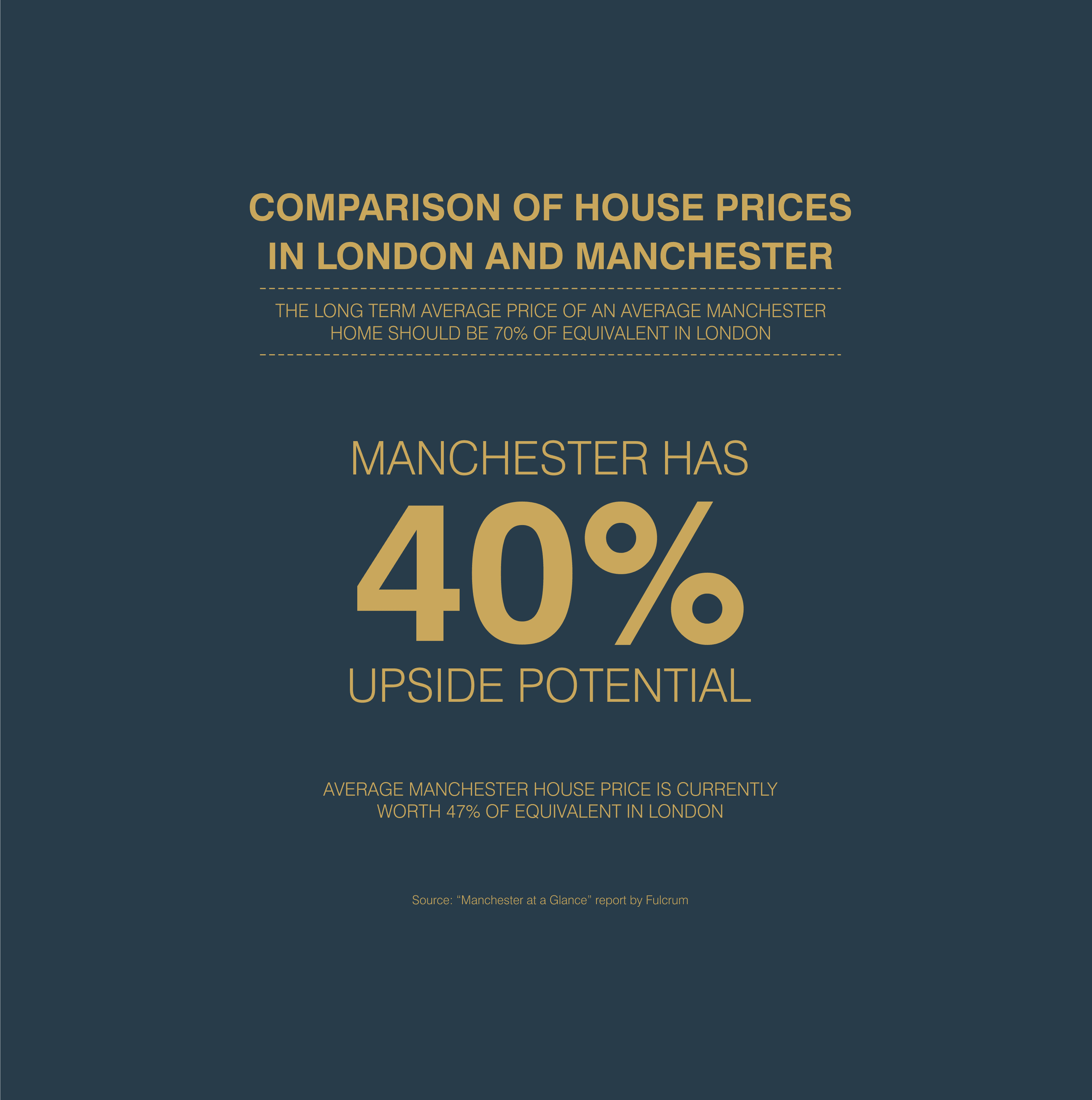

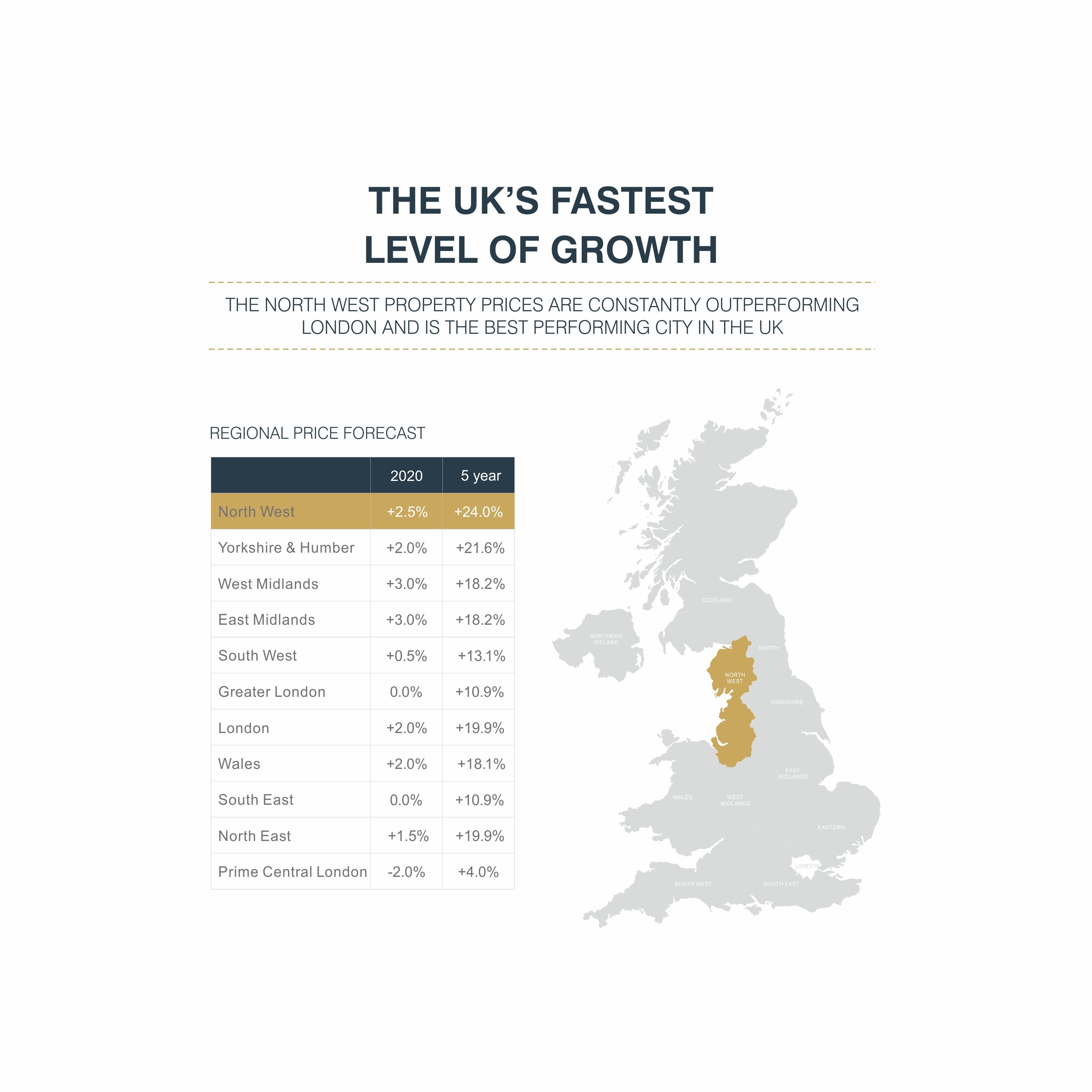

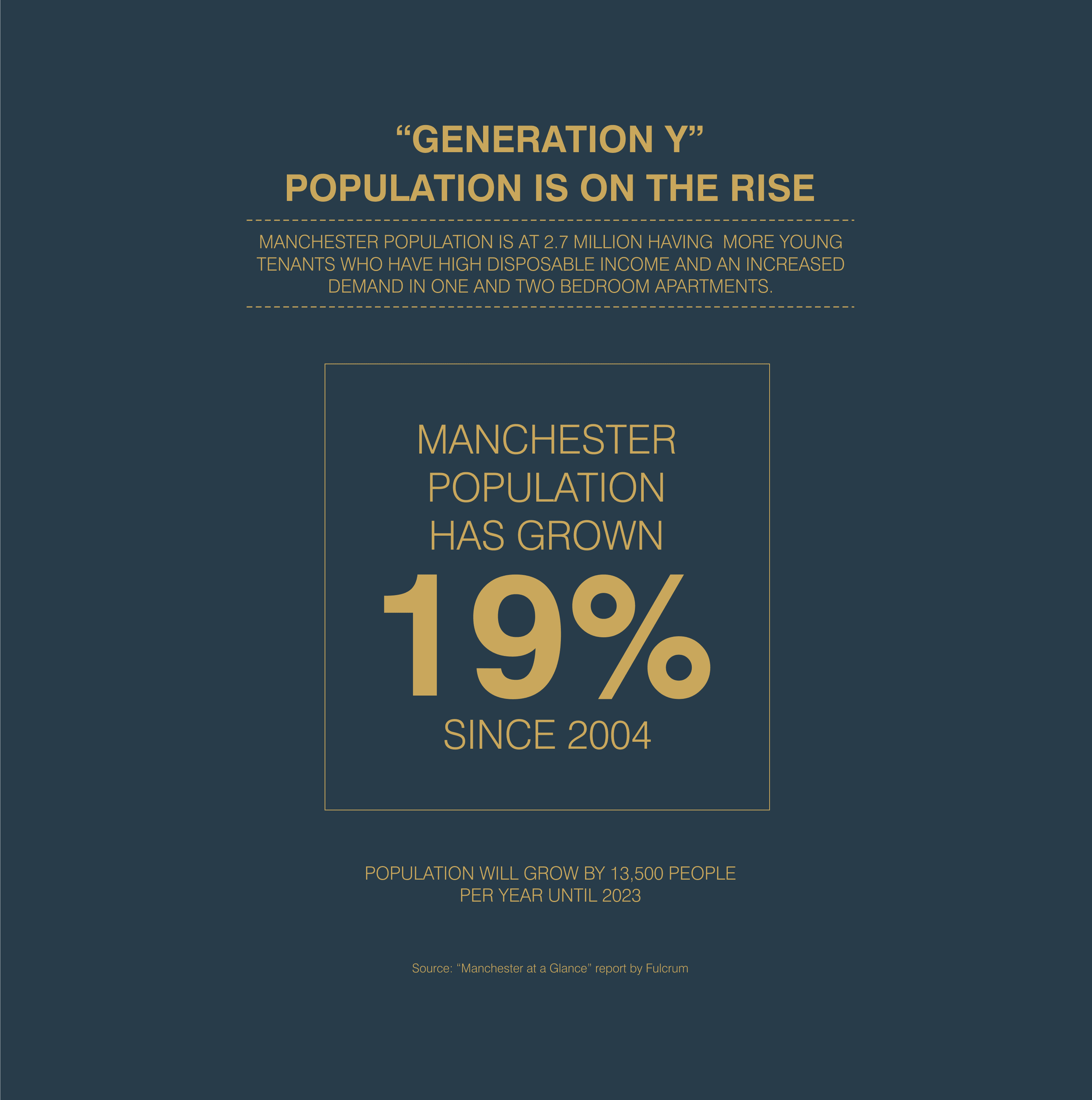

Savills predicts average property prices in the North West region will grow by 18.8% by 2026.

Rental values are forecast to grow 4% on average in 2022, according to JLL’s Manchester residential market forecast.

JLL forecasts Manchester to have the highest rate of house price change in 2022, with a 6% rise.

Oxford Economics predict Manchester to have the highest economic growth of all UK cities over the next five years, with a growth rate of 16.4%.

A Completely Hands-off Investment Opportunity

- WEEKLY CLEANING

- WEEKLY TOWELS AND BEDDING

- HIGH SPEED BROADBAND

- PHONE LINE RENTAL

- BUILDINGS INSURANCE

- MANAGEMENT OF YOUR PROPERTY

- GROUND RENT

- RESIDENCE SECURITY

- POOL MAINTENANCE

- GYM MAINTENANCE

- JACUZZI MAINTENANCE

- MARKETING OF PROPERTY FOR RENTALS

- 24 HR CONCIERGE SERVICE

- UTILITY BILLS

- DRY CLEANING / LAUNDRY SERVICES

There are huge opportunities in this sector as average rates for corporate apartments are normally lower than hotels, thus representing huge savings for corporate travel. From an investment perspective, owners benefit from higher occupancy and lower operating cost than hotels.

As reported by Savills, the sector lacks institutional grade stock on any large scale. It is this that is limiting transaction activity. This is likely to improve over the next 5 to 10 years as more developers deliver purpose built stock into the market.

A corporate lease arrangement makes sense for property owners who value the comfort and high security level of tenants whose financial soundness is vouchsafed to the highest possible degree. They are also ideal for owners who seek the sustained cash flow assured by long-term leases, since corporate leases are generally signed for durations of either 24 or 36 months.